Merchant vessel SSL Kolkata catches fire, most of goods are burned. What should be noted in International trade?

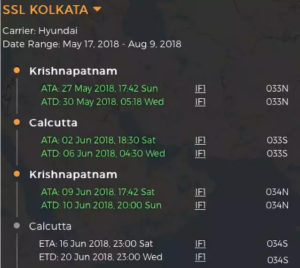

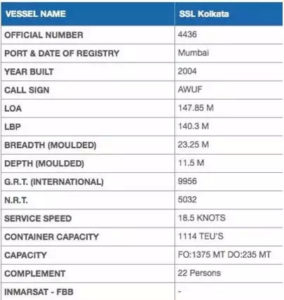

The container carrier was on coastal voyage from Krishnapatnam to Kolkata with the 22 crew members and 464 containers.

By the time the rescue team reached MV SSL Kolkata, about 70 percent of the vessel was on fire and master of the vessel had abandoned.

On 14th June 2018, the fire broke out due to explosion in one of the container and gradually it spread over.

Fortunately, the Indian Coast Guard responded quickly. After the Indian Coast Guard received the alarm, it dispatched rescue ships and planes to the rescue site in time for the rescue. At present, 22 crew members have all been rescued!

The container ship with a large fire was named SSL KOLKATA with a capacity of 1118TEU. At the time, the incident took place from Krishnapatnam, India’s largest transit port, to Calcutta!

A few hundred containers may never reach Calcutta!

According to statistics, this 1118Teu container vessel serves at least Maersk, Hyundai Merchant Marine, Star Ship, MCC, Gold Star and many other well-known shipping companies!

It is understood that the accident occurred in the container ship belongs to a local shipping company in India Shreyas Shipping & Logistics. The main business of this company is to provide barge services between the major ports in India to major shipping companies around the world!

In view of the large-scale container ship that involved Maersk and modern commercial ships and many other internationally renowned ship companies, the hundreds of containers that were devastated by the fires were also dominated by goods from major Chinese ports.

If the cause of the fire confirmation is that some freight forwarders have deliberately reported missing dangerous goods, the terminal port or shipping company will step up efforts to severely strike and punish dangerous goods! This will involve tens of thousands of unblemished containers and a large number of foreign trade logistics companies.

In the near future, there are a number of shipping companies and foreign trade and freight forwarding companies that export to relevant ports in India need to maintain communication with the relevant shipping companies and pay close attention to the damage situation!

How to clean up the aftermath of the fire

In the face of this fire, the shipping company and all cargo owners that have goods on board will be unavoidable and can only face it!

The goods were burned and miserable!

If the goods are not burned by chance, they will also face general average liability!

Did not buy insurance, miserable!

If you have already bought insurance, you will have a long way to go even if you can recover some of the damage!

CIF term, the owner who did not buy the insurance, and the goods were burned, belonged to the most unlucky ones. Unable to get the money, but also to pay the general average, but also to pay the shipping company to the shipping company, have to assume the consignee’s possible “claims”, and so all the responsibility of the shipper must bear.

CIF term, bought the insurance, the owner of the goods was burned, the payment can claim from the insurance company (depending on the type of insurance you bought), to pay general average (this fee can also claim from the insurance company, but also depends on your insurance Type), to pay the freight.

FOB term, consignee assumes risks and responsibilities. However, if the consignee refuses to pay or goes bankrupt, shipper needs to bear all losses.

For shippers who do not have insurance:

The first thing to judge is whether the cabinet has been damaged.

According to international practice, if the cargo of the owner is burned out, the shipping company will ask the owner for the packing list and invoice at the time of customs declaration, check the value of the goods, and compensate part of the loss in proportion;

If the cargo is not lost, it will need to give the shipping company a certain fee to share the loss of the damaged cargo on board (the shipping company will find a third-party organization to assess the loss),

This is the common practice of international average in the world, after which the shipping company will arrange the transfer (the time will not be too much hope).

What is general average?

The so-called general average refers to the special expenses and special expenses incurred by ships, cargoes and other property in the same sea voyage when they encounter common dangers, and for common security, intentionally and reasonably taking measures.

Ships loaded with cargo encounter wind and waves. Property damage caused by discarding a portion of cargo to prevent the overturning of ships is a general average.

Since general average is a loss caused by common security, it should be shared among the various beneficiaries and should not be borne solely by the injured party.

General average is a system unique to maritime law established on the basis of special maritime risks. It is of great significance for avoiding losses caused by typhoons, tsunami, stranding, collisions, collisions and other dangers of ship and cargo.

The conditions for the establishment of general average are:

- Ships, cargo and other property must meet common dangers;

- Measures taken for common security must be intentional and reasonable;

- Sacrifice and expenses must be special;

- The measures taken have achieved results.

The scope of general average includes common average loss and general average expenses.

General average loss includes:

- Loss of abandoned goods;

- Losses caused by extinguishing fires on board;

- Cut off the loss of the damaged part;

- Loss caused by voluntary stranding;

- Loss of machine and boiler damage;

- Burned off as marine materials and materials;

- Losses caused during the unloading process;

- Loss of freight.

General average expenses include:

- Salvage rewards;

- Stranded ship deduction costs;

- Costs at ports of refuge;

- Alternative cost

- Advance fee and general average interest;

- Adjustment costs.

After the general average occurs, in order to determine the general average rate of compensation, general average adjustments must be carried out, that is, the general average adjuster determines the items and amounts of general average loss and expenses according to the adjustment rules, and the apportionment of the beneficiaries. The value and the amount of assessment will eventually be compiled for general average adjustments.

And this will be a long process!

The general average adjustment program includes the following three stages:

First, it is necessary to determine the total amount of general average, that is, the total amount of special expenses incurred due to common average measures and the special expenses paid. In this way, it can be determined how much general average there is shared by each beneficiary.

In this general average, the total amount of general average should be calculated on the value of the damaged consignor’s cargo when it is loaded in Osaka plus insurance premiums and freight, minus the freight that does not have to be paid after the cargo is lost.

Second, to determine the value of general average assessments, the purpose is to apportion general average according to how much each beneficiary benefits.

Determine the apportioned amount of each beneficiary. In practice, the following general steps are used to calculate the general average amount of the beneficiaries’ apportionment:

- The general average rate of damage is calculated by dividing the total amount of general average damage by the total value of common average assessment. That is, the general average loss rate = the total amount of general average/the total value of common average assessment × 100%.

- The share value of each beneficiary is multiplied by the general average loss rate respectively to obtain the common average amount of losses that each beneficiary should share, ie the amount of general average which should be shared by each beneficiary = the apportioned value of each beneficiary x common average loss rate.

In order to ship safely, please buy insurance. And what the most important is that declare dangerous goods truthfully. Do not ship dangerous goods without transport license.

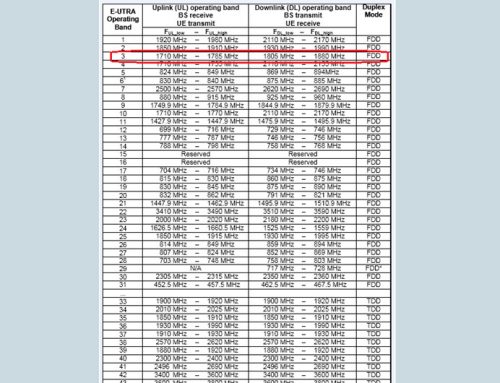

For example, in air and shipment shipments, battery report of MSDS and UN38.3 , shipment licenses are needed to make sure the battery safety. All of our batteries used in fixed wireless telephones and fixed wireless terminal are safety and with reports. Please feel free to order.